Tax Services

corporations and individuals are increasingly encountering the very different and complex United States tax system. Our US Tax Services Group assists corporations and individuals to safely maneuver their way through this system by giving effective US tax planning and preparation of all necessary corporate and personal income tax filings for US expatriates.

Since 1993 we have provided accurate, reliable and affordable tax service to clients from 12 states, the USVI and PR.

In addition to our tax services our accountant is also an IRS ERO (Electronic Return Originator) and can assist you e-filing our return or e-filing forms.

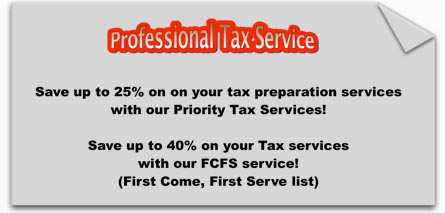

2013 Tax Season Specials

Fee $aver specials

1040-EZ….$25 Federal /$15 per State tax return.

1040-EZ….$25 Federal /$15 per State tax return.

Includes 1 W-2, NO DEPENDENTS, NO DEDUCTIONS,filing and taxpayer’s paper copies .

1040-A $195 Federal/ per $60 State.

Includes up to 2 W-2s, Child Tax Credit, Earned Income Tax Credit and paper copies.

1040 from $295 Federal / $95 per state.

Includes up to 2 W-2s, Child Tax Credit, Earned Income Tax Credit, Sch A, Sch C (EZ) and paper copies.

Anytime Special

Save 20% on your anytime tax and receive 1 e-file free of charge.

Off Season Special

Save 40% on your tax preparation fees from June1st to October 1st!

If your taxes are past due or you have one or more years without filing your tax returns, call us today to help you get up-to-date!

If your taxes are past due or you have one or more years without filing your tax returns, call us today to help you get up-to-date!

Call us at 919-202-9727 or 919-359-1357 and we will help you to get better results legally.

We can help you with tax preparation, tax planning, audits and IRS representation. We will help you reduce your tax liability legally, that way we can help you reduce your tax liability or get a larger refund. We also keep your information private and secured.

Since 1993 we have provided accurate, reliable and affordable tax service to clients from 12 states, the USVI and PR.